Tesloop’s figures indicate that on a per mile basis, the cost of a Robotaxi operating (software) platform might be $0.01 a mile. In addition, Tesloop notes that we might have to pay parking fees as a part of the Robotaxi’s work, so let’s assume that their number of $720 a year is valid. In addition, they estimate they paid about $0.01 a mile for vehicle washing and cleaning labor. They also accounted for tires separately at $0.01 a mile.

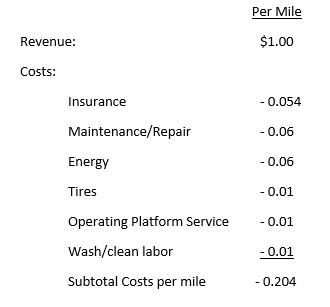

Given these assumptions, here’s what our financial business model looks like on a per mile basis.

As three ballpark checks on our cost per mile assumption, Tesloop’s experience using Model Ss and Xs over some 2.5 million miles was less than 25 cents a mile (remember free Tesla Supercharging for them), Model 3s and Ys have demonstrated a cost of about 25 cents per mile, and Elon Musk says a Robotaxi’s cost per mile should be about 18 cents a mile (eventually, and stripped of a lot of today’s equipment).

I have managed to develop my own spreadsheet that mirrors that of Tesloop’s here (not without some struggle, but my numbers match theirs).

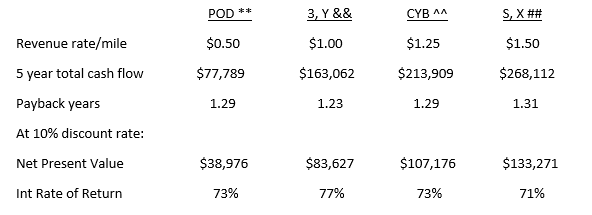

I have run four spreadsheet scenarios for the four classes of Robotaxis listed earlier, varying multiple factors. I show below the results of just one set of runs, consistent across the four scenarios. In this set of runs I used a 50% utilization rate for chargeable time, when one or more customers is in the vehicle.

** Assumptions changed as follows: dollar cost per mile for insurance – .03; maintenance and repairs – .03; energy – .03; tires – .003, otherwise same as 3, Y

&& Assumptions: insurance – .054; maintenance and repairs – .06; energy – .06; tires – .0085; operating platform – .01; wash/clean labor – .01

^^ Assumptions: same as 3, Y except tire cost doubled to .017

## Assumptions: same as 3, Y

In all cases straight line depreciation used over five years, and a $720 parking fee per year use.

The utilization rate can never reach 100% as every vehicle needs downtime for charging, maintenance, and repair, and washing and cleaning. I have used a conservative 10% discount or interest rate in the above set of runs. Lowering the discount rate will raise the Net Present Value (NPV) in each investment scenario.

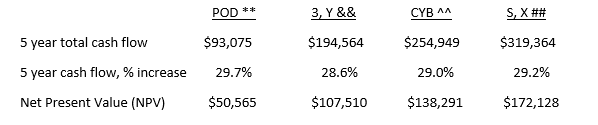

Observe that whatever model scenario we examine, the financial returns are very attractive. Obviously if the utilization percentage increases, the financial picture gets even better, as noted below when we use a 60% utilization rate, all other factors remaining the same.

It’s obvious that we won’t be able to charge $1.00 to $1.50 a mile revenue for more than a couple of years. Tesla should be in the lead in driving that figure down, keeping maximum pressure on any possible competitors. The question is how long (in years) will it take for the revenue to decrease to an unsustainable level for all but the largest market players with the deepest pockets. Also, note that we have not factored in any future reductions in any of the cost numbers we have used. Ultimately, for any combination of revenue and costs each person or investor has to judge what level of profit and return on their investment is adequate for them.

In Robotaxi projections that extend over a decade or more, forecasters such as Tony Seba see the cost to consumers for a Robotaxi mile lowering to 5 or 10 cents a mile, when hundreds of thousands of Robotaxis are in use each over their million mile lifetime. The Robotaxi business will be a low margin volume business (chargeable miles), not a high margin business.

Now here’s where the magic comes in! Remember, we are in the Robotaxi fleet business. So far, we only have been talking about one vehicle. Multiply the one-vehicle numbers above by any fleet size you want. Even with a minimum investment and fleet size of ten PODS (total investment $200,000), you have the potential to make what should be a minimum of $215,578 a year for five years — not a bad living. Of course, the profits get better as the Robotaxi fleet utilization increases. Furthermore, the larger your Robotaxi fleet, the more negotiating power you have with your suppliers on the cost side, the more “market presence” you have on streets and highways, and the more likely you can respond on a timely basis to customer demand. No urban user will wait very long for a Robotaxi to appear!

Musk has talked of having a fleet of a million Robotaxis in the US! The combined rental car fleet in the US is about 2.2 million vehicles – so Musk’s number is not so extravagant as we have not factored in the existing number of ride sharing vehicles, taxis, and limousines in addition to the number of rental cars.

While Musk’s Robotaxi vision (perhaps think much further in the future) is that of urban area Robotaxis that last 1 million miles, Tesloop’s experience is that regional intercity Robotaxiing is a better business. Imagine, for instance Robotaxi service (people, parcels, or both) between Austin, Dallas/Fort Worth, Houston, and San Antonio, Texas. Long range high-speed intercity routes maximize the chargeable miles in a minimum of time and such Robotaxis are likely to be more lucrative for their owner. There are many reasons for this.

In an urban Robotaxi environment, the customer is liable to not be too particular about the type of vehicle they ride in. After all, they are likely to be in it for 20 minutes or less and only ride a few blocks or miles. As long as the Robotaxi is reasonably clean, and either the heat or A/C works, all is well. Moreover, they are not likely to be too concerned about safety – the speeds in an urban environment are relatively low. Also an urban driving environment is far less predictable – many stop lights, much congestion and traffic, trucks blocking streets, etc.. Suddenly, even with delay charging, you may lose money during a long traffic tie-up.

Realize that when you are carrying paying passengers some two to four hours in a vehicle that you are really in the hospitality business. Here, customers do care about the luxury, prestige, comfort, and appearance (inside and out) of the vehicle. In-car Internet access and entertainment also counts in the hospitality business, for business people who want to work while riding, or for people just on a short leisure trip. Some customers may be eager to take their first ride in an electric-powered vehicle, especially a Tesla that they have heard so much about.

On a long distance high-speed trip, customers care very much about safety – that of the driver (if one) and especially that of the car. Here, Tesla’s record is unimpeachable, and in fact with Autopilot and later Full Self Driving, the Tesla vehicle makes the trip even safer than in any other vehicle. Note too that in the case of a three to four hour trip or maybe less, a planned bathroom stop (ideally at a Starbucks) is an absolute necessity. During the 20 minutes or so that this usually takes for three or four people, the Robotaxi might even sneak in 20 minutes of charging that will top up the vehicle’s battery with another 100 to 200 miles of driving range.

Ideally, if you were going to operate a fleet of regional intercity Robotaxis, it would be wise to base some of your vehicles in each city. This would provide you with more flexibility and minimize the chances that you would have to deadhead a vehicle to another (or your single home) city.

The TaaS business will be huge:

Consider the impact of owning a huge fleet of Robotaxis. Musk is talking about a million of them in the US. Let’s stay with that number, and again use 50% as a utilization rate. Thus, one Robotaxi would be earning money 12 hours a day on average, or 4,380 hours a year.

Using the Model 3, Y spreadsheet model referenced earlier, we see a profit of $32,612 per year per vehicle generated by an investment of $40,000 in buying the Robotaxi and having it operated at a 50% utilization rate. One million such Robotaxis would generate $32.612 Billion in profit per year.

If we come down to earth and evaluate a fleet of 100 Robotaxis, then our profit per year should be $3.2612 Million per year, for an initial $4 Million investment. Over five years that investment pays back $16.3062 Million.

An owner with 10 Robotaxis for an investment of $400,000 would generate an annual profit of $32,612 for each Robotaxi, or over five years a total of $1.63 Million.

There are so many variables to play with in evaluating the Robotaxi business. But one thing is for sure, there’s a horse in that barn somewhere!

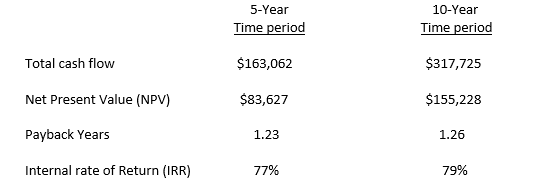

Tony Seba writes that the million-mile battery and autonomous vehicle make the Robotaxi possible, economical, and capable of making so much money for its owners. He points out that it is the ability to depreciate a Robotaxi over ten years that lowers the depreciation charge each year and allows more income per year to be realized. I have used my spreadsheet model to extend the five-year timeframe I used to the ten years he recommends. Here are the results for a Model 3, Y Robotaxi with a cost of $40,000 and a 50% utilization rate, and a 10% discount rate as in the examples above:

Anticipating Seba’s “race to the bottom” in Robotaxi pricing, he is correct that with the lower depreciation over a ten-year depreciation period, you gain some extra profit as the Robotaxi pricing is forced down by competition and even more beneficial technology. That is to say, with the five year time frame, your NPV reaches zero at about $0.45 a mile, whereas for the ten-year time frame it doesn’t turn negative until about $0.36 a mile. The profit goal is to keep prices as high as possible while you work on lowering costs. There’s no glory in joining the race to the bottom until you have to.

Despite the more attractive numbers for the ten-year scenario, I am not convinced a 10-year life for any intense service vehicle such as a Robotaxi is feasible, whether battery electric-powered or ICE-powered. Today’s technology is changing too fast, and all we know is that tomorrow’s technology will evolve faster. Software, of course, is infinitely upgradable with OTA updates. But computer hardware changes too, and those components have to be manually swapped and that costs the owner money and downtime. In addition, new drive technologies will become prevalent such as in-(wheel) hub motors – an in-wheel motor for each wheel. Things such as doors and door handles/mechanisms, upholstery, seat padding, computer screens, and the like will need regular replacement. Outer body parts will become dented, scratched, or faded and will need repainting or refreshing. Styling will become dated and need upgrading. It’s the same reason many people buy or lease a new vehicle every three years – they want the technology and styling of a new vehicle and they are bored with their old vehicle. In the Robotaxi world, given a choice between a relatively new and shiny Robotaxi or a high-mileage obviously older one, guess which one customers will reserve or summon every time.

In addition, as speculative as it is to estimate prices and costs out five years, it is even more speculative and risky to estimate these matters out ten years. This is particularly true in a new and untested industry with no actual Robotaxi models (without driver controls) that exist today, and an utter lack of hard data from Robotaxi investment and use. Spreadsheet models are useful for understanding the underlying economics and the influences of key business variables, and for evaluating multiple “what-if” scenarios. But many entrepreneurs become wedded to their spreadsheet models and fail to anticipate or recognize that more often than not every business and environmental factor (including the “unknown unknowns”) changes.

Moreover, there are a variety of social factors at play in the adoption of Robotaxis. For instance, will our current COVID-19 pandemic experience push people back toward their private vehicles and away from public transportation and ride sharing? Finally, there is utter legal mess and confusion that exists between state and local laws and regulations – including insurance company standards — regarding autonomous vehicles. Intelligently formulated new Federal laws are needed to provide a coherent legal framework for this emerging industry. Today, we cannot predict how all this will turn out given our messy democratic process and state versus Federal government tug-of-war. Stay tuned……….

Image courtesy Pixabay

Your feedback in the form of comments or suggestions are welcome in the comment window. Thank you for following my blogs on this site and for participating in my blogging community.

2 Responses

An owner with 10 Robotaxis for an investment of $400,000 would generate an annual profit of $32,612, or over five years a total of $1,63 Million.

Picky, picky! S/b $326,120 and $1.63 Million.

OR $32,612 for each Robotaxi… and $1.63…

Good to read this. Doesn’t take a half hour of talking heads making clever jokes, etc.!

Thanks Al for cathching that….TG