Tesla’s Ginormous Insatiable Need for Batteries – Here’s What the Numbers Show!

Well, someone has to do it! Elon Musk has often said that Tesla is really a battery company that just happens to make cars. He clearly has done the math on Tesla’s battery needs, probably in his cyber-brain. We know that Tesla has been battery constrained for a long time and that has prevented Tesla from producing its Cybertruck and Semi trucks when first introduced to customers, who immediately ordered them in significant quantities.

Someone outside of Tesla has to forecast just how much Tesla needs batteries to attain its sustainability, growth, and profit goals. As an engineer, I want to understand these numbers, at least on a ballpark basis. In this article, I will be discussing battery needs only pertaining to Tesla’s vehicles. I am not sure sufficient numbers are available to the public to serve as a basis for calculating Tesla’s energy storage battery requirements. However, if you double the vehicle-based numbers I am about to discuss, you won’t be far off Tesla’s current total battery needs. Get ready for some outrageous numbers!

We know a new battery cell and assorted battery packs designed and produced by Tesla are coming – – it’s likely they already exist in secret testing. I will consider the effect of this much improved and lower cost battery design at the end of this article. My purpose here is to forecast estimated Tesla vehicle sales through 2025 and understand how these numbers dictate Tesla’s battery strategy and needs. While I have all these numbers detailed out in a complex spreadsheet, I will keep this post at a summary level. It’s complicated enough in this overview.

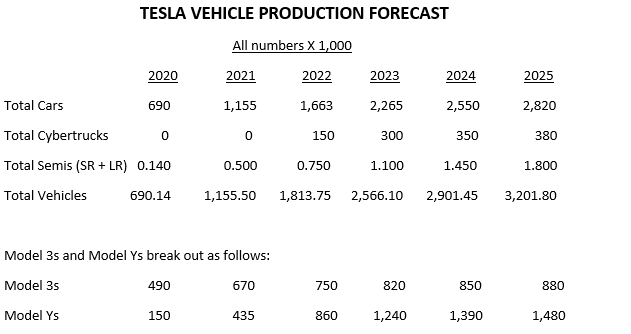

My forecast numbers cover all manufacturing plants that exist now and are known to be coming in the next five years. They also cover all Tesla models known to exist or be coming in the next five years including the Model 2 that will be produced in Shanghai for the Chinese market (initially). Here is a high level view of my production forecast.

Plant assignments are as follows:

Fremont: Models S, X, 3, and Y

Shanghai: Models 3, Y, and 2

Berlin: Model Y

Texas: Model Y and Cybertruck

Somewhere, maybe Nevada or Tulsa: Semi

Of secondary interest to this article, note that at an average vehicle sale price of $50,000 each, by the end of 2025 if these numbers are reasonable, Tesla vehicles (excluding solar, energy storage and management, and the Boring Company) will be a $160 Billion business. But even in the face of robust product demand, that won’t happen if Tesla can’t react proactively and effectively to the following battery demands.

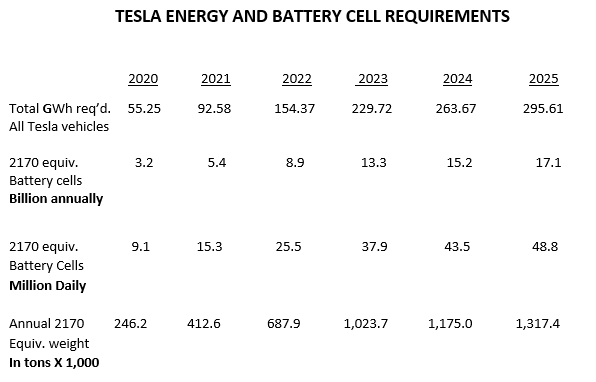

Battery Requirements Projection:

Here, without access to more detailed Tesla-internal information, we have to make some simplifying assumptions. I can easily change any or all of these assumptions, including the production estimates, in my spreadsheet model.

- All cars except the Model 2 have an 80 kWh battery pack. The Model 2 has a 40 kWh battery pack.

- Cybertruck models are calculated as the order breakdown shown in the Cybertruck Owners Club database – single motor 8% of orders, dual motor 50%, and triple motor 42%. Assumed battery pack sizes for the three models are 80 kWh, 100 kWh, and 200 kWh, respectively.

- The short range Semi’s battery pack is 200 kWh. The long range version’s is 400 kWh.

- For ease of estimation, all battery needs are based on Tesla/Panasonic’s 2170 battery cells (their best to date) or “2170 cell equivalents”, even though we know the S and X use Panasonic 18650s, and the Chinese model 3 (perhaps the Y also?) use CATL’s battery. Nonetheless, this assumption gives us an easy way to get our arms around the magnitude of Tesla’s overall battery requirements.

- The 2170 battery cell’s energy is 17.3 Wh, and its weight is 70 grams (0.15419 pounds).

- Battery production occurs 350 days per year at all battery plants

When all the math is done, the battery cell numbers are so enormous that in order to fit them on these pages I will have to use industry standard terms to describe them as follows: Thousand = Kilo = 1,000; Million = Mega = 1,000,000; Billion = Giga = 1,000,000,000; and Trillion = Tera = 1,000,000,000,000. You’ll see that when Musk said he needed a “Terafactory” he was stretching things a bit – though only out to 2030 or so. Here are the 2170 battery cell equivalent numbers based on the assumptions above. Read the Wh prefix and units closely!

Note that the 2025 numbers are roughly 5.35 times the 2020 numbers, representing a compound annual growth rate of 40% in terms of battery cell requirements.

In contrast to these numbers, Tesla’s Nevada Gigafactory was designed for 35 GWh of cell production a year, but due to yield problems has apparently never attained that goal. At 30 GWh a year, that’s 1.734 billion 2170 cells per year or when divided by 350, about 5 million battery cells a day! This is only about 55% of Tesla’s current 2020 needs. No wonder Musk is buying batteries wherever he can get them — CATL for China’s Model 3, LG Chem in China and now South Korea, in addition to their existing arrangement with Panasonic.

Not surprisingly in view of the above, Tesla will soon be starting production of its own new design battery cells. This will be the new production process and production line that will be eventually installed in each Tesla vehicle manufacturing plant. Tesla’s new battery design will eventually be installed in every Tesla vehicle and given the ongoing rate of battery improvement could keep Tesla out front in battery development for at least seven years, if not forever.

By 2025 in my calculations, cars consume 82% of Tesla’s batteries, the Cybertruck 18%, and the Semis (surprisingly) only 0.2%. The latter number is simply a function of the relatively low truck volume forecasted, despite the Semi’s huge battery pack sizes. Even doubling or tripling my Semi production volume estimates has little overall effect on total battery cell consumption.

To summarize Tesla’s immediate (!) 2170 battery cell equivalent requirements for 2020 and the next five years reads as follows:

- A total of 1,091.2 GWh of battery power is required

- A total of 63.1 Billion 2170 cell equivalents is required

- By 2025 Tesla must be supplied with 48.8 million 2170 cell equivalents a day

- From a logistics point of view at a minimum, by 2025 Tesla could be receiving or shipping over 2.6 billion pounds of raw materials or batteries annually. This is why it makes sense for each Tesla manufacturing plant to have its own battery production line, or one very close by. Ditto for the proximity – – at least here in the US – – of its raw material mines such as those for lithium. Shipping this tonnage long distances is prohibitively expensive.

I repeat: these numbers are for Tesla vehicles only. As a first approximation, double these numbers for the energy storage side of Tesla’s business. The numbers above, while staggering, obviously don’t include those of all the other global auto and truck manufacturers who will eventually have to convert to all battery powered electric vehicles. The competition for a guaranteed high performance battery supply chain for EVs will be fierce. Today, the EV battery industry is woefully short of capacity, and for the most part behind Tesla regarding battery performance. Tesla’s batteries and battery management systems are far and away the industry leader in performance. Musk is pushing hard for Tesla to be self-sufficient as soon as possible with regard to battery manufacturing capacity, and to vigorously pursue its research and efforts in battery chemistry innovation and improved battery production processes.

But you say wait – – Tesla is about to bring out their new much improved battery, announcing it on Battery Day now scheduled for September 15th, 2020. Won’t that reduce the need for this numbers of cells you outline above? The answer is yes, depending……. This is where Tesla’s strategy comes into play. Tesla could take the energy improvement from its new battery cells and reduce the cell count in its cell packs and keep its vehicle’s ranges about the same. This might reduce vehicle weight (that alone somewhat extends the range) and lower battery cost – – allowing for lower vehicle prices. Or they could increase the battery pack energy to extend each vehicles’ range. Alternatively, they could split the difference on an individual vehicle basis. You might reduce the 2170 equivalent requirements I cite by some 20% to allow for the new batteries’ effectiveness, but that hardly alters the overall battery requirement picture. It only moves higher battery requirements out a year or two.

But that brings up the $64,000 question: How much range is enough range for the EV consumer? As the Lady said: “You can never be too tall, too thin, or too wealthy”. Or as the Guys say: “You can never have too much horsepower!” Today’s prospective EV consumers have deep founded range anxiety. This concern will diminish with EV experience, better EV batteries, the availability of more charging locations, cheaper electrical power, and not to forget — cheaper solar roof power for “free” home charging. After all, no one has an infinitely large gas tank in their ICE-powered cars or trucks. Ultimately, we learn to live within our vehicles’ means. Maybe the EV industry will converge on a 450 or 500 mile range limit for standard passenger cars and pickups. After all, how many people drive that far in a day? And no one has that large a bladder!

Now, off the record as I am not a financial advisor, but after digesting the information above, I would suggest that you not get stars in your eyes and rush out and buy battery raw material mine stocks or the stocks of battery manufacturers. Those are commodity businesses with low margins. If you want to buy stock, buy it in Tesla as they have all this stuff above figured out and IMO are on their way to becoming the US’s next Trillion dollar company. Just saying…………..

Your feedback in the form of comments or suggestions are welcome in the comment window. Thank you for following my blogs on this site and for participating in my blogging community.

Image courtesy Pixabay

PS: I have calculated the number of 2170 battery cell equivalents needed for each Tesla commercial Megapack, Powerpack, and home Powerwall. The numbers I haven’t been able to find yet are Tesla’s installed base of each battery storage unit. If I can dig them up, I will perform this same analysis for the energy side of Tesla’s business. Stay tuned……………..

One Response

Hi, the delivery numbers are to linear. 3 million by 2023, 6 million by 2025.

Cybertruck is going to start in 2021 and they will do 50k at least.