Rethinking Humanity ….. Elon Musk and Henry Ford ….. Oil and Gas Industry Continues to Decline

**** New Tony Seba and James Arbib book!

As readers may know my writings on this blogsite are in part based on the teachings of Tony Seba and his research organization RethinkX. A recent David Orban video interview with Seba alerted me to his new book Rethinking Humanity written by James Arbib and Tony Seba and published by RethinkX. This is an amazing paperback book, only 74 pages of text long in 8.5 X 11 inch format — chock full of beautiful graphs and charts and printed on quality paper. Readers can find it on Amazon for about $26 or download it for free in PDF format from rethinkx.com. The printed version, in color, is far nicer than a black and white version printed from the PDF. The book is an extraordinary read.

Rethinking Humanity adds to Seba and his RethinkX associates’ previous work, including five books, and builds on that framework to review the fundamental technological disruption converging across five industry sectors – information, energy, transport, food, and materials. That disruption is occurring at an accelerating rate and will continue to play out over the coming decade. The authors point out that on the one hand such change will be hugely beneficial for individuals and society, while on the other hand our very existence is threatened as we are stuck with political views, governing institutions, and laws formed in another era. In addition our current leaders do not seem to understand, or to be able to encourage and harness these potentially positive changes. Indeed, without changing our current social and governmental “Organizing System”, we could be headed for the end of our country and world as we know it.

In my view, this stimulating and well-researched book should be required reading for every global citizen. Entire K-12, and college courses (text, video, and lecture-based) could and should be built upon the facts and projections outlined by Arbib and Seba in Rethinking Humanity. Unlike previous disruptive changes, Seba and Arbib argue that for the first time, we can forecast these coming disruptive changes and plan for them – if we are smart and act now. The book concludes with specific suggestions for ensuring that we move forward to take full advantage of the benefits that disruptive technological change can confer to our global society. This is a remarkably high impact and well-written book that will change your view of life and our role in society. Please read it.

Author Vitaliy Katsenelson coined a quote that I have made one critical change to that captures the ideas in Rethinking Humanity, namely: “As necessity is the mother of invention, disruption can be the mother of innovation.”

**** Elon Musk and Henry Ford both agree on one thing

In the above mentioned book, there is a wonderful quote of Henry Ford and his thoughts on his famous $5 a day wage, with an additional comment from Arbib and Seba. I was reminded of how Ford’s thinking would fit right in with Elon Musk’s philosophy.

Here’s the quote from page 19: “In 1924, Ford doubled its workers’ wages, raising eyebrows throughout the industry and beyond. Two years later [Ford’s] profits had doubled and within seven years it owned half the US auto market. The move to attract and retain talent had proved a masterstroke. ‘The payment of $5 a day for an eight-hour day was one of the finest cost-cutting moves we ever made,’ Henry Ford later said.”

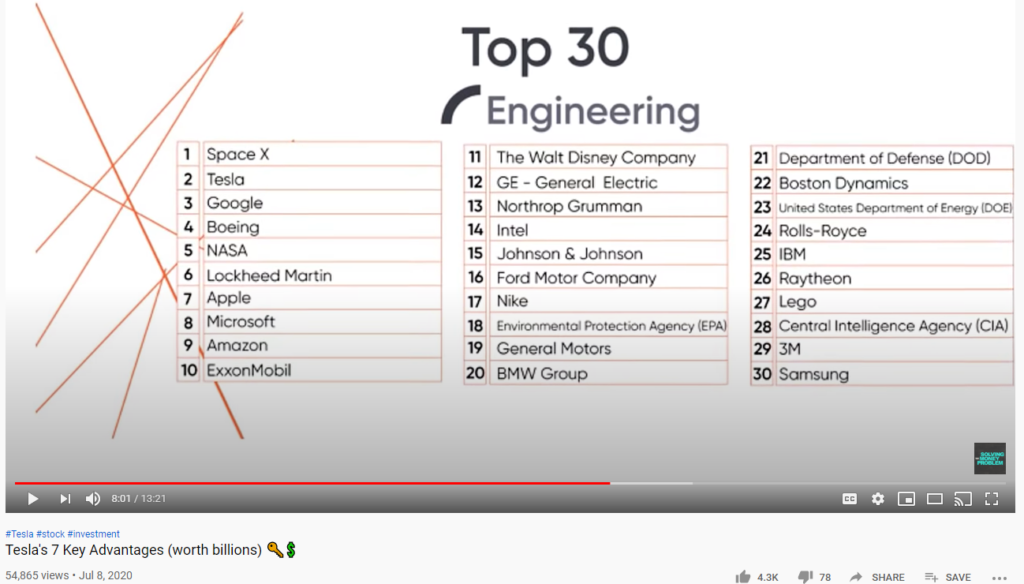

If there’s one thing every Musk and Tesla follower knows it is the premium Musk places on attracting the very finest engineering talent and employees, setting high expectations for them, and paying them well. The culture Musk has created at both SpaceX and Tesla make those two companies the most sought after global companies to work for by graduating engineers. Shades of Henry Ford!

BTW: It’s too early to say whether Tesla’s Models 3 and Y will be the battery-powered electric “Model T’s” of their era, but the analogy is not too far-fetched. Sorry readers, it will take even Tesla a few decades to surpass the ICE-powered Toyota Corolla in cumulative production numbers – – 48 million units over 54 years.

**** Good news recently on several fronts

- One oil pipeline closed, one cancelled, and one in limbo. The further construction of the Keystone XL oil pipeline from Canada to Nebraska was rejected by the US Supreme Court. Soon after, the proposed Atlantic Coast Pipeline across the Appalachian Trial and through to North Carolina and Virginia was cancelled by its two utility sponsors Duke Energy and Dominion Energy. A third pipeline, the infamous Dakota Access pipeline from North Dakota to Illinois was stopped by a federal judge’s ruling and told that it had to empty the pipeline of all oil. This seeming victory was partially reversed by an appeals court ruling that said the pipeline could continue shipping oil while the case works its way though the court system to a conclusion. As a recent article in the New York Times suggests, this may signal the end of new oil and gas pipeline construction in the US.

- During the past couple of weeks, the market cap of Tesla passed that of Toyota to make Tesla the world’s most valuable automobile manufacturing company. This is confirmation that the market values Tesla more for its goals to increase the world’s sustainable energy than for the volume of cars that it can turn out. While Toyota is one of the highest volume automotive producers, it – along with Honda — is one of the Japanese laggards in its pursuit of the battery powered electric market, despite its early start with its Prius hybrid and more recently plug-in hybrid Prius.

- In another hugely symbolic event, Tesla also recently exceeded the market cap of Exxon. What could be more fitting that Tesla — a battery, electric vehicle, and solar power/energy storage company — could be now seen as more valuable than one of the world’s largest conventional oil and gas companies.

- It’s also worth noting that Google has recently dropped its development of AI tools to help the oil and gas industry to improve the extraction of crude oil. [Axios Login, 5/20/2020]

- In the past three years several banks and investment houses such as The World Bank, UBS Bank, Morgan Stanley, and Goldman Sachs have all said they will no longer finance oil and gas exploration.

- In an encouraging move in Denmark, where by 2035 all vehicles sold have to have zero emissions, the bank Merkur Andelskasse announced that from now on it will only provide loans for electric vehicles – both battery powered and plug-in hybrids. They will no longer finance gas and diesel-powered automobiles. Where are the leading US banks with regard to this matter? The Danish bank’s new policy may be a bit extreme for the US market at this point, but why aren’t environmentally conscious US banks and credit unions offering markedly lower finance rates for auto loans on battery-powered electric vehicles?

- Just in today are two more articles that document the continuing decline of the oil and gas industry. In Fossil Fuel Companies are Losing Value Globally, Johhna Crider details the loss in oil and gas industry value over the past decade, citing the decline of the Australian S&P ASX 300 Energy Index, comprised of mainly fossil fuel companies. In addition, the US S&P 500 Energy Index showed that the index has declined by about one-third in absolute terms from its inception 10 years ago. The article notes that the Morgan Stanley Capital International Index (MSCI): “also saw fossil fuel companies underperform”.

- In an accompanying CleanTechnica article FERC Data Shows Fossil Fuels Are Failing George Harvey writes that “For the first time, FERC is projecting a net decline of US fossil fuel capacity over the next three years.” [FERC is the US Federal Energy Regulatory Commission.] He adds: “Coal, oil, and natural gas are suffering because they are increasingly obsolete.” Well said!

The good news items above (and there are many, many more of them I could cite) are sure signs that the disruptive turn Tony Seba and James Arbib write and speak about is picking up speed. It will only accelerate in the future, for the technological changes in those five sectors they focus upon are all on exponential curves and their convergence. Another example: don’t look for any new electric power plants to ever be built in the US (and increasingly around the world), even “peaker” plants – whether coal, gas, or nuclear fueled. Solar with battery storage has already won. Much more on that later……

Image courtesy of Pixabay

Your feedback in the form of comments or suggestions are welcome in the comment window. Thank you for following my blogs on this site and for participating in my blogging community.